LAS VEGAS—Despite fears of automotive market saturation, there were dozens of companies offering lidar sensors for automotive and other uses at CES. Some companies are offering products for markets besides auto OEMs.

PreAct Technologies announced new flash lidar sensors: Sahara, Borrego and Moab for agriculture, healthcare, smart cities, retail, security, transportation and education markets. “They are variants of our Mojave sensor. They have higher power and a wider field of view,” said Paul Drysch, PreAct co-founder and CEO.

While still strong in automotive markets, Drysch said that the robotis, retail and security segments are growth areas. At CES, the company partnered with Outsight for monitoring people in high-traffic areas such as airports and rail stations.

“Outsight was paying $2,000 to $3,000 for lidar pucks. While we may not have same range, at $200, they can put the lidar in hallways, entry points and other areas for a magnitude of lower cost,” Drysch said.

In retail, lidar use is taking off. “We have a proof of concept with one of the largest fast food chains for operational efficiency. They want to find out how many people are waiting line, how long they wait, when they go to the restrooms, do they slip and fall, where is trash build up,” he said.

Also at CES, Chinese lidar company RoboSense rolled out its M2 and M3 sensors. The M3 is designed for Level 3 automated driving, while the M2 is a lower-cost version of previous lidar sensors.

Owl Autonomous Imaging Promotes Thermal Tech to OEMs

In other CES auto news, Owl Autonomous Imaging is touting its thermal imaging technology, which is going down in price and is accurate, to OEMs.

Thermal imaging has a long history, but lacked resolution and had a high cost in the past. “We are coming out with a megapixel solution in the 2028-2029 timeframe that will only be a few hundred dollars to an OEM, not the $10,000 that it is today. It is really changing the marketplace,” said Wade Appelman, Owl Autonomous Imaging chief business officer.

Appelman said that lidar does not have enough resolution, or pixels to accurately target individuals. “Thermal doesn’t give you lidar’s ranging accuracy, but it isn’t bad. While there are $500 lidar systems right now, the companies are losing money on them,” he said. “It doesn’t take an OEM long to replace a $500 system with a $200 system.”

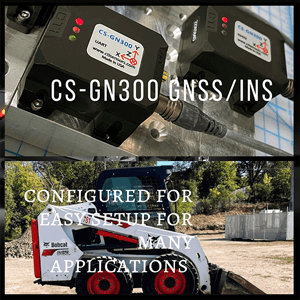

While the thermal auto market will be driven by OEMs that will bring the price of thermal systems down, other use cases include construction vehicles, conveyor belt movers, smart cities and drones, Appelman said.

In other CES news:

- Mobileye MBLY -1.82%↓ said its lidar was selected by “a major Western automaker.” The deal includes integration of its SuperVision, Chauffeur and Drive to multiple brands.